All Categories

Featured

Table of Contents

- – Accredited Investor Passive Income Programs

- – Groundbreaking Accredited Investor Secured Inv...

- – Renowned Accredited Investor Investment Returns

- – Leading Investment Platforms For Accredited I...

- – Innovative Accredited Investor Platforms

- – First-Class Accredited Investor Alternative ...

- – Exclusive Accredited Investor Crowdfunding O...

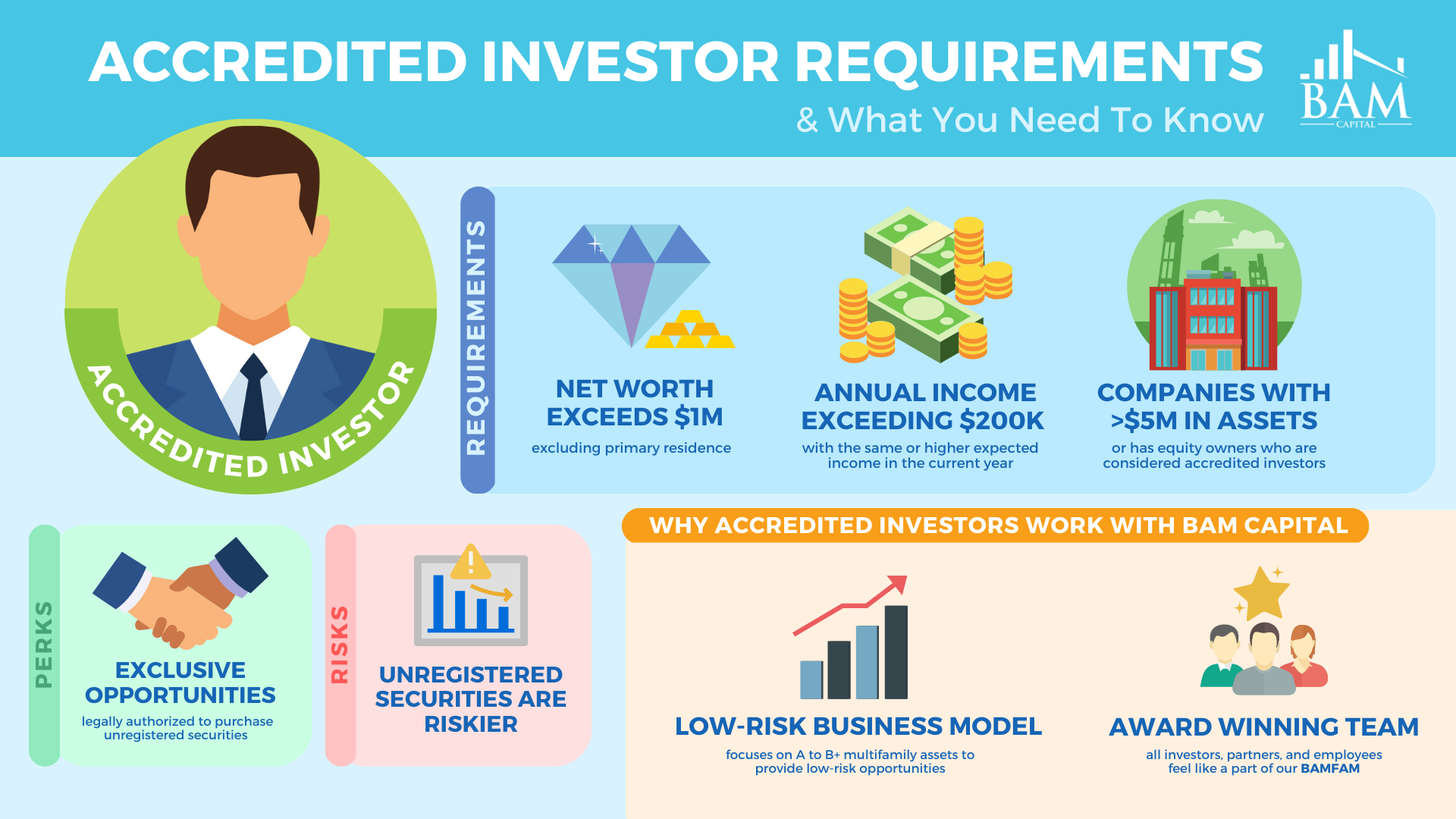

The policies for recognized capitalists vary amongst jurisdictions. In the U.S, the meaning of an approved capitalist is presented by the SEC in Policy 501 of Guideline D. To be a recognized investor, an individual has to have a yearly revenue surpassing $200,000 ($300,000 for joint earnings) for the last 2 years with the expectation of making the exact same or a greater earnings in the current year.

This quantity can not include a main house., executive officers, or supervisors of a firm that is issuing non listed safety and securities.

Accredited Investor Passive Income Programs

Likewise, if an entity consists of equity owners that are certified capitalists, the entity itself is a certified financier. However, a company can not be created with the sole purpose of purchasing certain safeties - investment platforms for accredited investors. A person can qualify as an approved financier by showing sufficient education and learning or work experience in the economic market

People that wish to be accredited capitalists do not apply to the SEC for the classification. Instead, it is the obligation of the company supplying a personal placement to make certain that all of those come close to are recognized capitalists. People or parties who want to be accredited investors can approach the issuer of the non listed safety and securities.

For instance, mean there is a specific whose revenue was $150,000 for the last 3 years. They reported a main home worth of $1 million (with a home mortgage of $200,000), a vehicle worth $100,000 (with an exceptional car loan of $50,000), a 401(k) account with $500,000, and an interest-bearing account with $450,000.

This person's web worth is precisely $1 million. Because they fulfill the internet well worth requirement, they qualify to be a recognized financier.

Groundbreaking Accredited Investor Secured Investment Opportunities

There are a few less common credentials, such as handling a trust fund with greater than $5 million in properties. Under government safeties legislations, only those that are approved capitalists might get involved in certain safety and securities offerings. These may include shares in exclusive positionings, structured products, and private equity or bush funds, to name a few.

The regulatory authorities intend to be particular that individuals in these highly high-risk and complicated investments can fend for themselves and evaluate the threats in the lack of federal government protection. The recognized investor guidelines are designed to safeguard possible investors with restricted financial understanding from adventures and losses they may be sick geared up to endure.

Certified financiers fulfill qualifications and professional criteria to gain access to exclusive financial investment chances. Accredited capitalists have to satisfy revenue and web well worth requirements, unlike non-accredited people, and can spend without restrictions.

Renowned Accredited Investor Investment Returns

Some vital modifications made in 2020 by the SEC consist of:. This change identifies that these entity types are typically made use of for making investments.

This adjustment make up the impacts of inflation over time. These changes expand the certified investor swimming pool by about 64 million Americans. This larger gain access to offers extra possibilities for investors, yet additionally increases prospective threats as less financially sophisticated, capitalists can take part. Companies making use of exclusive offerings may gain from a larger swimming pool of prospective financiers.

These financial investment choices are exclusive to accredited financiers and institutions that qualify as an approved, per SEC regulations. This offers accredited capitalists the possibility to spend in arising firms at a phase before they take into consideration going public.

Leading Investment Platforms For Accredited Investors

They are considered as financial investments and are obtainable only, to certified customers. Along with well-known firms, certified investors can pick to buy start-ups and promising ventures. This supplies them tax returns and the opportunity to go into at an earlier phase and possibly gain rewards if the firm prospers.

For investors open to the dangers included, backing startups can lead to gains (accredited investor real estate investment networks). Several of today's technology firms such as Facebook, Uber and Airbnb came from as early-stage start-ups sustained by approved angel capitalists. Sophisticated capitalists have the possibility to check out financial investment choices that might generate extra earnings than what public markets offer

Innovative Accredited Investor Platforms

Although returns are not guaranteed, diversification and portfolio enhancement alternatives are broadened for financiers. By expanding their portfolios through these expanded financial investment methods approved capitalists can enhance their strategies and potentially accomplish premium long-lasting returns with appropriate danger management. Seasoned capitalists often come across financial investment choices that might not be conveniently offered to the basic capitalist.

Financial investment choices and safety and securities provided to recognized financiers typically include greater risks. Private equity, endeavor funding and bush funds typically focus on spending in properties that lug threat yet can be sold off conveniently for the possibility of higher returns on those dangerous investments. Researching before spending is crucial these in situations.

Secure durations prevent capitalists from withdrawing funds for more months and years at a time. There is additionally much less transparency and regulatory oversight of private funds contrasted to public markets. Capitalists might battle to precisely value private properties. When taking care of dangers accredited investors require to examine any exclusive financial investments and the fund managers entailed.

First-Class Accredited Investor Alternative Asset Investments for High Returns

This adjustment may prolong accredited capitalist status to a series of individuals. Updating the income and asset benchmarks for inflation to guarantee they reflect adjustments as time advances. The current limits have remained fixed given that 1982. Permitting companions in dedicated partnerships to integrate their sources for shared qualification as recognized financiers.

Enabling individuals with specific expert accreditations, such as Series 7 or CFA, to certify as certified financiers. This would recognize financial refinement. Creating extra demands such as proof of financial proficiency or successfully finishing a certified capitalist exam. This can make sure financiers comprehend the risks. Limiting or eliminating the primary home from the internet worth computation to reduce potentially filled with air analyses of wide range.

On the other hand, it could also lead to experienced financiers thinking too much dangers that might not appropriate for them. Safeguards may be required. Existing certified financiers might encounter raised competition for the very best investment opportunities if the swimming pool grows. Business raising funds might take advantage of an expanded certified investor base to attract from.

Exclusive Accredited Investor Crowdfunding Opportunities

Those who are presently thought about certified investors have to remain updated on any alterations to the requirements and laws. Services looking for certified capitalists must stay cautious about these updates to ensure they are bring in the ideal audience of capitalists.

Table of Contents

- – Accredited Investor Passive Income Programs

- – Groundbreaking Accredited Investor Secured Inv...

- – Renowned Accredited Investor Investment Returns

- – Leading Investment Platforms For Accredited I...

- – Innovative Accredited Investor Platforms

- – First-Class Accredited Investor Alternative ...

- – Exclusive Accredited Investor Crowdfunding O...

Latest Posts

Back Tax Sales

Paying Back Taxes On Property

Real Estate Tax Sale Law

More

Latest Posts

Back Tax Sales

Paying Back Taxes On Property

Real Estate Tax Sale Law