All Categories

Featured

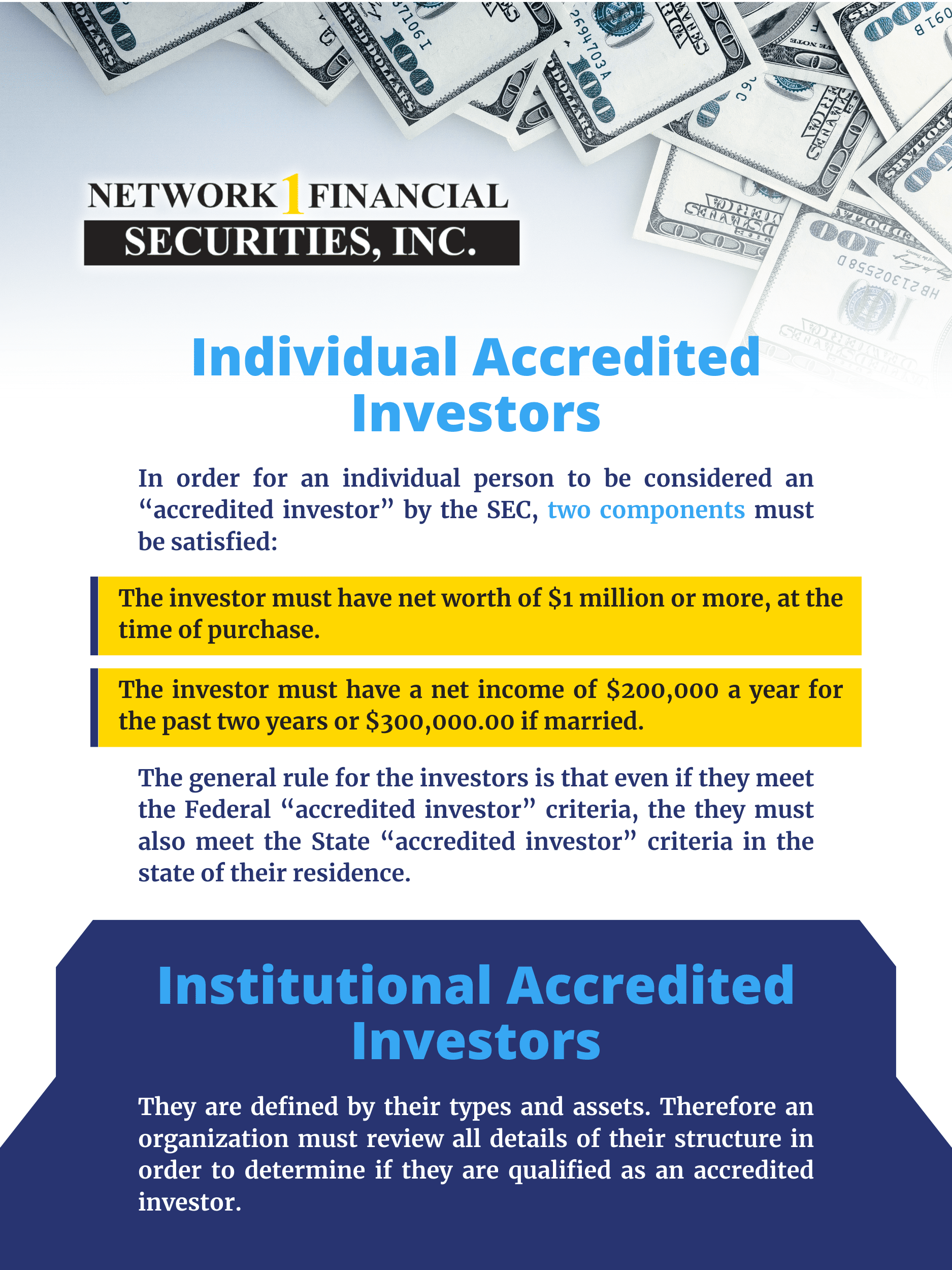

A financial investment vehicle, such as a fund, would certainly need to figure out that you qualify as an approved capitalist - new accredited investor rules. To do this, they would certainly ask you to submit a survey and perhaps give particular documents, such as economic statements, credit history records. accredited investor income, or tax obligation returns. The benefits of being a certified financier consist of access to distinct investment chances not readily available to non-accredited financiers, high returns, and boosted diversification in your profile.

In particular regions, non-accredited financiers likewise have the right to rescission (accredited investor questionnaire form). What this indicates is that if a capitalist decides they desire to take out their cash early, they can assert they were a non-accredited investor the entire time and get their refund. However, it's never ever a good idea to offer falsified files, such as phony income tax return or financial declarations to a financial investment car simply to invest, and this can bring legal problem for you down the line - accredited investor look through.

That being claimed, each deal or each fund might have its own constraints and caps on investment amounts that they will certainly accept from a financier. Certified capitalists are those that meet particular demands regarding earnings, certifications, or web worth.

Latest Posts

Back Tax Sales

Paying Back Taxes On Property

Real Estate Tax Sale Law